Why Public Schools?

Eight Reasons Why Public Dollars Should Stay With Public School* Students

1. PUBLIC SCHOOLS ARE OPEN TO ALL – Public schools proudly take every student who comes to enroll. Private schools can pick and choose among applicants and can reject any student without an explanation. Charter schools, although considered “public” under the law, often do not provide transportation to and from school, and often have enrollment through lottery. The inclusiveness of traditional public schools requires support and resources.

2. PUBLIC SCHOOLS ARE THE BEDROCK OF DEMOCRACY – Public schools have been the key institution responsible for teaching about and perpetuating our democracy. Public schools are required by law to provide good citizenship instruction (IC20-30-5-6), to display the flag, and to “provide a daily opportunity to for students of the school corporation to voluntarily recite the Pledge of Allegiance in each classroom.” Charter schools since their creation by a 2001 law have been exempt from these basic citizenship laws, while in private schools, civic education laws are not monitored or enforced.

3. PUBLIC SCHOOLS NEED FINANCIAL STABILITY – Traditional public schools need stable support to maintain and improve programs. Any incentive created by the General Assembly to use public funds to attract students to private schools or privately-run schools, such as charter or virtual or innovation schools, will mean less money for the public school since the money follows the child. This dollar drain undercuts the stability of public school programs.

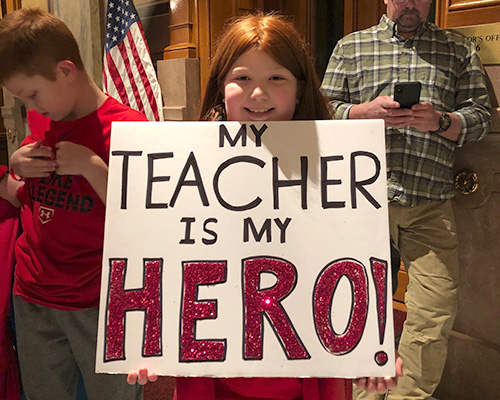

4. PUBLIC SCHOOLS ARE CENTERS OF THE COMMUNITY – Traditional public schools bring the entire community together regardless of background. This coming together from all walks of life teaches our children to respect and value differences—an essential part of living in a pluralistic, religiously diverse society. By contrast, shifting to a publicly funded set of small private schools will fragment our community along religious and philosophical lines.

5. PUBLIC SCHOOLS SERVE ALL INCOME LEVELS – Claims that vouchers are being directed to low income families ring hollow; the private school tax credit enacted in 2009 provides scholarships to families earning up to $230,880 for a family of four (2023-24). Few would consider this to be “low-income.” In addition, families living in extreme poverty often do not have the resources or transportation needed for their children to attend charter schools. Others do not have the ability to navigate complicated systems of enrollment required by charter schools.

6. PUBLIC SCHOOLS HAVE STEADILY IMPROVED – Claims that Indiana’s traditional public school performance is declining are simply untrue. Few are aware that on the National Assessment of Educational Progress (NAEP), “the nation’s report card,” Indiana has outperformed the national average on all 56 NAEP basic assessments since 1990. Steady improvement over the past 25 years in Indiana’s public schools was clearly documented in a 2015 report that showed Indiana’s public schools standing at or near their highest marks in history on attendance rate, SAT math, ACT, National Assessment, ISTEP+, and percentage earning Academic Honors diplomas and Core 40 diplomas. Of course, more improvement is always needed to meet the changing demands of our society and economy and in order to fulfill the promise of educational equity– but diverting students to private schools undercuts support and hampers further improvement in public schools. Parents who press leaders to fund improvements for their traditional public schools will simply be told to take their child to a private school if they don’t like their public school.

7. PUBLIC SCHOOLS ARE NOT SECTARIAN – Statistics show that the number one consideration for parents using a voucher for their child or children is to provide them with a religious education and not the academic quality of the school. Taxpayers, however, should not be obligated to send students to parochial schools even if that is the choice of the parents. That is why the Indiana Constitution says: “No money shall be drawn from the treasury, for the benefit of any religious or theological institution.” In addition, it says “no person shall be compelled to attend, erect or support, any place of worship, or to maintain any ministry, against his consent.” Our public policies must avoid financial entanglements with religious schools, which are often defined as ministries by those running them.

8. PUBLIC SCHOOLS ARE TRANSPARENT – Citizens can track how their money is being spent.

*Our organization does not consider charters or so-called “innovation schools” to be public schools, though they are called that in state law. Charters and “innovation schools” do not share the following accountability requirements with public school districts: 1) to serve all students within a given geographic area, 2) to be governed by a democratically elected local board (“innovation schools” are outsourced within districts, while charters appoint their own boards), and 3) to follow the full body of state education law, including teacher certification requirements and financial reporting requirements.

Not a member? Donate and join today!

Questions? Contact us at info@indianacoalitionforpubliced.org