Legislative Alert: SB 1 Amended – Devastating Consequences for Public Schools

SB 1

Various property tax reform bills floated this session have been rolled into one bill—SB 1. This bill threatens to harm, even cripple, many vital public services like libraries and fire departments in our Hoosier communities. Our immediate focus is on the devastating consequences for public schools. We recognize that seniors and other vulnerable Hoosiers are hurting due to property taxes; however, we are aware of no viable plan to replace this essential funding. Although amendments have been made to lessen these cuts, the reality remains that after 15 years of chronic underfunding, public schools are in no position to absorb further financial strain. The big cuts are in the language which will completely phase out (over 3 years) business personal property taxes.

SB 518 is one of the bills that have been inserted as an amendment to SB 1. This would require public school districts across Indiana to split local property tax dollars, as well as any future operating referendum dollars, with charter schools. Charter schools are privately-run entities and taxpayers have no voice in their decisions. This amounts to taxation without representation. With one third of all charter schools having closed down in Marion County, this lack of stability is not just bad for communities – it hurts kids.

Another aspect of this amended version of SB 1 is that it calls for the “cancellation” of Union School Corporation in Randolph County. No one in their school district was included in this decision and their superintendent is warning that more school districts could be next. We note that Union School Corporation was one of the five school districts listed for dissolution in HB 1136.

On top of these proposed cuts and loss of local control, there is terrible uncertainty with regards to:

1. The future of federal funding for Hoosier public schools due to the dissolution of the federal Department of Education.

2. The K-12 tuition support funding in HB1001 is inadequate and not commensurate with the functional needs of our traditional public schools, with about half of the new funding earmarked for more vouchers to support private school tuition for Indiana’s most wealthy families.

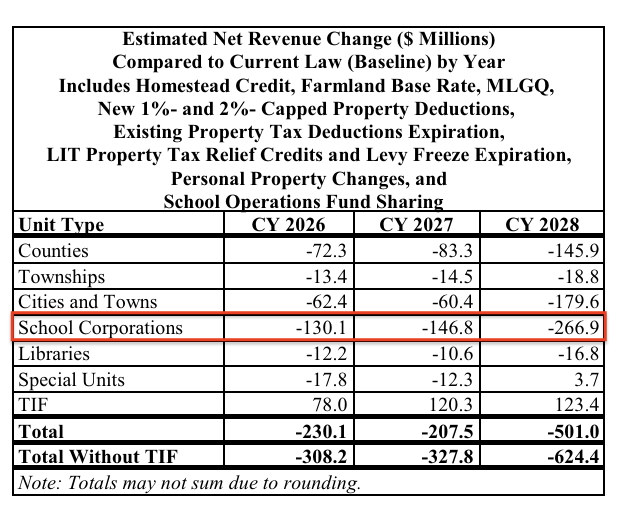

Here are the potential losses for school corporations and other community services for the next three years. You can find your individual school district losses here. It is important to note that splitting property taxes with charter schools does not start until 2028 and will add even more losses.

While the losses are less than the original bill, they are still potentially devastating to local public school districts.

Across three years, the total loss is $544 million for public schools. 2026 – $130.1 million, 2027 – $146.8 million, and 2028 – $266.9 million.

These bills won’t be finalized until the session wraps up (sine die).

Serious changes will likely need to be made in many, if not most, districts. Look for schools closing, larger classroom sizes, district consolidations, putting building repairs and bus purchases on hold, reducing the number of elective and extracurriculars, higher out-of-pocket costs for parents for after school activities, and so on, as a result with this loss of funding. How does this help Hoosier kids?

What To Do

Contact state representatives immediately and tell them you oppose SB 1.

(800) 382-9842 – House Democrats

(800) 382-9841 – House Republicans

Make this personal. This bill could be heard as early as Wednesday, April 9 in the House Session at 1:30pm. Reach out to your local representative. Let them know:

- A loss of revenue will harm our public schools and hurt our kids. Replace, don’t erase, any cuts to funding.

- This is taxation without representation. Public schools have locally elected boards, charter schools are privately operated.

- Charter schools receive state tax funding now. They also get millions of dollars in federal funding that public schools don’t. Shifting the burden to local taxpayers by siphoning local property taxes away from public schools will be costly and harmful.

- Legislators are forcing local property taxes to increase by splitting property taxes between public and charter schools.

* As always, please remember the following guidelines when reaching out to legislators:

- Remember to be polite and kind in your language and tone.

- Remind them public education is not a partisan issue.

- Encourage legislators to support legislation that strengthens public schools.

- Personal stories and anecdotes are particularly effective, whether it’s your own personal story or a close friend’s.

- Be disciplined in your messaging: the best way to build support for your position is to keep communication positive, bipartisan, inclusive, and single-issue.

- Avoid getting sidetracked with other issues you care about.

- If you are a constituent, mention that.