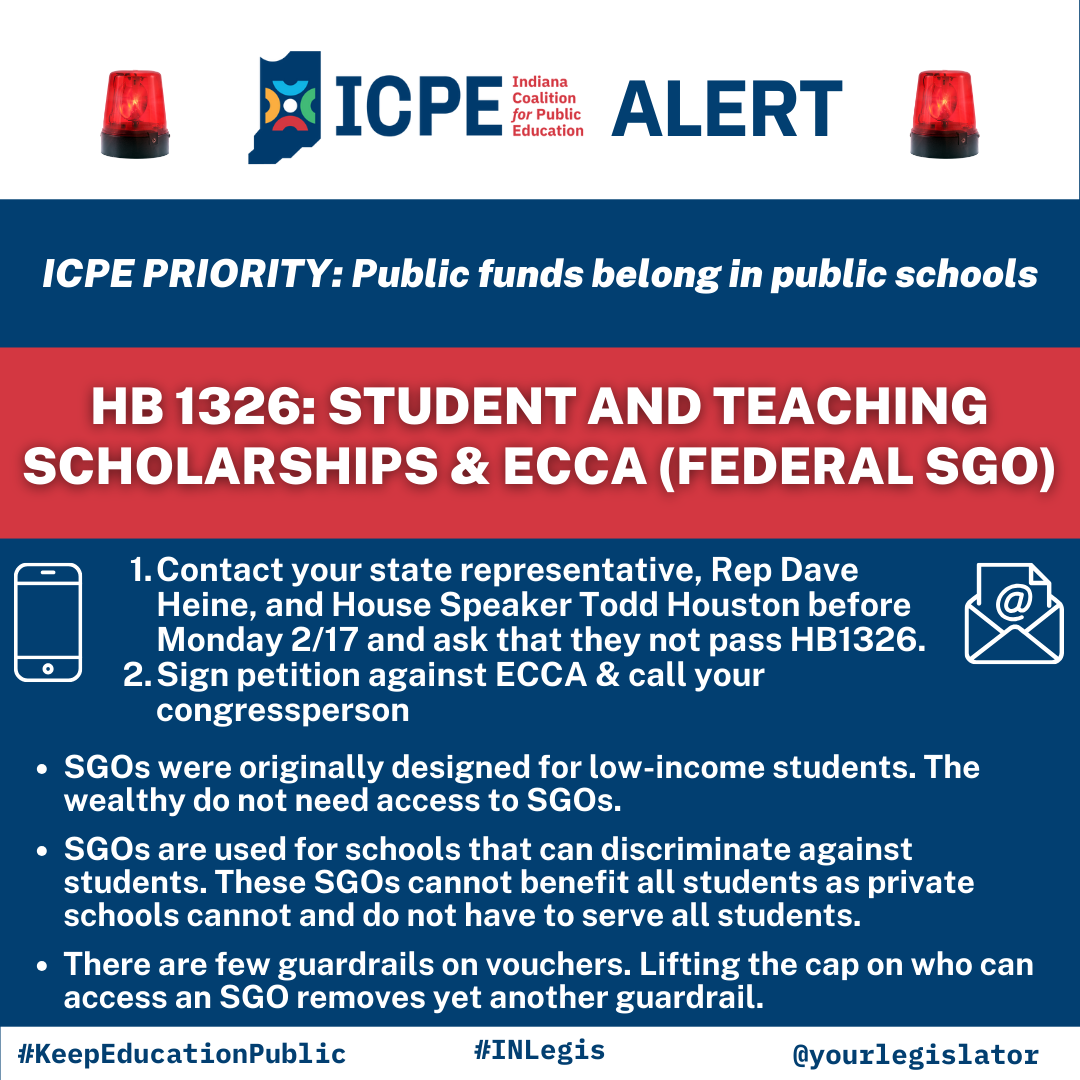

Legislative Alert: HB 1326 – Teaching and Student Scholarships AND ECCA (Federal SGO)

HB 1326 STUDENT AND TEACHING SCHOLARSHIPS and ECCA

Scholarships from scholarship granting organizations (SGOs) are a pre-tax voucher. They have been around for as long as Choice Scholarships (Indiana vouchers), but have not grown as fast as Choice Scholarships. Soon that may change.

This call-to-action is two-fold.

SGOs could grow in Indiana for two reasons:

- HB1326, authored by Rep. Dave Heine, will remove income limits just like Choice Scholarships will this year, allowing the wealthy to access this program. It will also expand eligibility to the scholarships to age 3.

- The Educational Choice for Children Act (H.R. 531, S.120, and H.R. 9462 in the 118th Congress) (ECCA) would offer a dollar for dollar, 100% federal tax credit for donating money or stocks to an SGO. (Indiana currently offers a 50% state tax credit for money donations).

Indiana SGOs function as a tax break for the wealthy and for corporations. They lessen the overall amount of tax dollars collected and, thus, shrink the revenue which pays for services and public schools. SGOs can only be used in private schools and private schools can openly and legally discriminate against students and families.

At the federal level, the ECCA is worse. It allows corporations and the wealthy to evade paying tax on capital gains while also giving them a 100% tax credit for the value of stock and their realized gains—which will both benefit wealthy, sophisticated investors, and funnel more money to private school vouchers.

The ECCA proposal prioritizes contributions to private school voucher programs over donations to organizations helping people in our local communities (i.e. veterans organizations, homeless shelters, houses of worship, or food banks). Individuals who give money for vouchers get a dollar-for-dollar tax credit, whereas donations to charitable organizations only garner a tax deduction. We know from our state-level voucher program that this will translate into benefits for the wealthy, at the cost of our most vulnerable children.

What to Do:

1. Contact your state representative, Rep Dave Heine, and House Speaker Todd Houston before Monday 2/17/25 and ask that they not pass HB1326.

-

- SGOs were originally designed for low-income students. The wealthy do not need access to SGOs.

- SGOs are used for schools that can discriminate against students. These SGOs cannot benefit all students as private schools cannot and do not have to serve all students.

- There are few guardrails on vouchers. Lifting the cap on who can access an SGO removes yet another guardrail.

Find your representative here.

Rep. Dave Heine (R) District 85 – Email: h85@iga.in.gov

Rep. Todd Huston, House Speaker (R) District 37 – Email: h37@iga.in.gov

2. Sign this petition against ECCA and call your Congressperson and ask that they not support this Educational Choice for Children Act. Tell them that you are against federal private school vouchers of any kind. Private schools can discriminate. The wealthy and corporations do not need a 100% tax credit.

- Rep Frank Mrvan (202) 225-2461

- Rep Rudy Yakym (202) 225-3915

- Rep Marlin Stutzman (202) 225-4436

- Rep Jim Baird (202) 225-5037

- Rep Victoria Spartz (202) 225-2276

- Rep Jefferson Shreve (202) 225-3021

- Rep Andre Carson (202) 225-4011

- Rep Mark Messmer (202) 225-4636

- Rep Erin Houchin (202) 225-5315