*UPDATE*Legislative Alert: SB 1 & SB 518 – Local Government Services Cuts – “Shot to the Heart”

SB 1, SB 443, SB 518

UPDATED 3/3/25 (scroll down to “What To Do”)

School funding is complicated and understanding taxes is mind-numbing. No one likes to pay taxes. But our communities greatly benefit from the services that come out of the taxes we pay, be it in our paycheck, on a purchase, or on property we own.

Property taxes have grown. So has inflation. It has not been financially easy for many of us.

There are major property tax reform bills being floated this session. These bills will affect—some say cripple—many services in our Hoosier communities (like libraries and fire departments). Below we will focus on schools. As of now (2/13/25), there is no replacement for these cuts. But there have been major amendments this week that – for now – lessen the cuts. But still, after 15 years of underfunding, the last thing public schools need is cuts.

On top of these proposed cuts, there is uncertainty in regards to

- What future federal funds may come to our state for education as the existence of a federal Department of Education is uncertain.

- The funding so far for K-12 tuition support in HB1001 is lackluster, to say the least, with about half of the new funding earmarked for NEW vouchers.

Here are the potential losses for school corporations via three major property tax bills as of 2/11/2025, calculated by the Legislative Services Agency (LSA).

Across three years, the total loss is $524 million for public schools. By 2028, we are over a $264 million annual deficit for our community public schools.

Now, it’s true, this is an improvement over the pre-amended bills where losses were nearly $2.4 billion across 3 years. The cuts are less bad. But they are still cuts. AND the session is not over. These bills won’t be finalized until the session wraps up (sine die).

None of the losses above is a drop in the bucket. Serious changes and cuts would need to be made in most districts. Nothing is safe in many districts. Look for schools closing, larger classroom sizes, district consolidation, putting building repairs and bus purchases on hold, reducing the number of elective and extracurriculars, higher out-of-pocket costs for parents for after school activities, and so on.

Bills Details

Status: Senate, Rule 66(b) Bills and Joint Resolutions on Second Reading, February 13, 2025

SB1 is Braun’s plan, his campaign pledge. This would reduce property taxes for some populations. It was heavily amended on 2/11. SBs 6 (property tax deferral), 8 (more rules for school referenda), and 9 (more tax caps and new criteria for Maximum Levy Growth Quotient) were rolled into the bill. A 93-page amendment also removed the amended homestead standard deduction. The repeal of the supplemental homestead deduction and tax caps from the bill was the source of the major cuts in local government funding, including schools. Keep in mind, this is not final yet. And even though there is an improvement, it is still a cut. And bigger cuts can come back.

This amended bill (on 2/11) will cost Indiana school districts about $370 million across three years according to the LSA (it was originally $1.9 billion for SB 1 and $67.4 million for SB 9).

Here is the LSA estimated revenue impact for the amended bill.

SB 443

Status: Senate Third Reading, February 13, 2025.

Senator Aaron Freeman is the author of the bill. This bill wanted to phase-out the current business personal property tax minimum valuation percentage from 30% to zero over a three-year period. It has been heavily amended. It now increases the acquisition cost threshold for the business personal property tax exemption from $80,000 to $100,000. But Senator Freeman’s goal is to get rid of this tax. As is, this bill still affects communities that have a lot of businesses.

This bill will cost Indiana school districts $2.4 million across three years according to the LSA (it was originally $288.7 million).

Here is the LSA estimated revenue impact for the amended bill.

SB 518

Status: Senate Second Reading, February 13, 2025.

There is no revenue impact analysis at the school corporation level on this bill. You need to ask your district what it will cost. LSA top level analysis is here.

Senators Linda Rogers, Jeff Raatz, and Mike Gaskill are the authors of this bill. This bill is the icing on the cake. First, this bill will require that property taxes earmarked for your local school district’s operations fund be shared with charter schools. Second, the losses due to SBs 1, 443, and 518 will likely force many school districts to ask for tax levy referenda to help make ends meet. This bill will require schools holding referenda to share tax levy funds with charter and innovation schools, beginning with referenda passed after May 2025. This bill is the worst bill of the bunch as it further pushes the responsibility of funding charter schools to local taxpayers. It will reduce the lump sum of $1,400 given by the state for each charter school student (to make up for a lack of property tax dollars), replacing it with local property tax dollars. Charter schools answer to authorizers, not local communities. This is taxation without representation.

This bill will cost Indiana school districts over $150 million across three years (this money would leave public control and go to privately managed charter schools).

What To Do

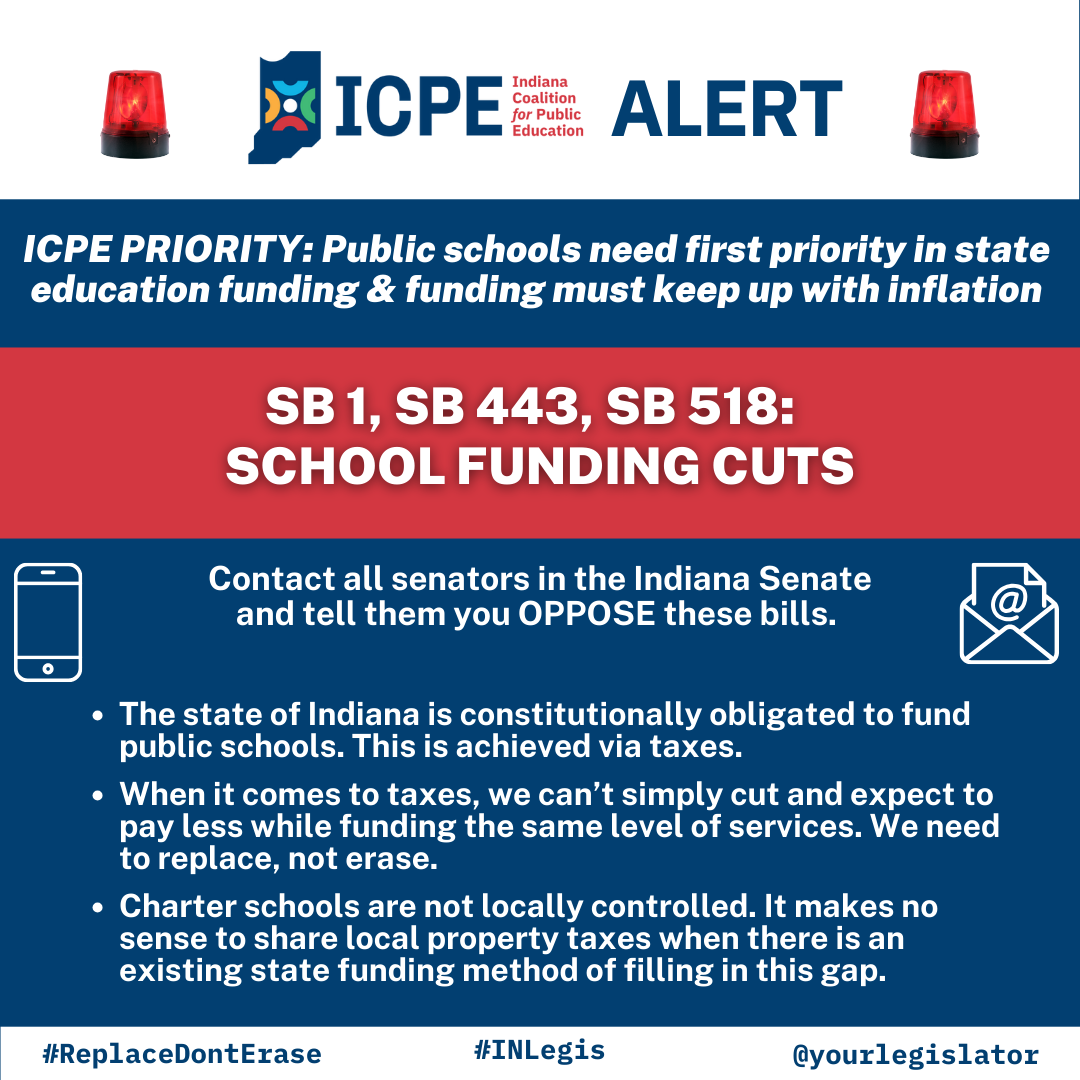

UPDATE as of 3/3/25: Contact state senators and tell them you oppose these bills. Tax Bills SB 1 (property tax cuts) and SB 518 (property tax sharing with charter schools) will be heard on Wednesday, March 5 in the House Ways & Means at 1:30pm. Reach out to the committee AND your local representative. Let them know:

- The state of Indiana is constitutionally obligated to fund public schools. This is achieved via taxes.

- When it comes to taxes, we can’t simply cut and expect to pay less while funding the same level of services. We need to replace, not erase revenue.

- Charter schools are not locally controlled. It makes no sense to share local property taxes when there is an existing state funding method of filling in this gap. This is taxation without representation.

House Ways & Means Committee Emails:

h28@iga.in.gov

h22@iga.in.gov

h78@iga.in.gov

h72@iga.in.gov

h15@iga.in.gov

h46@iga.in.gov

h17@iga.in.gov

h54@iga.in.gov

h47@iga.in.gov

h85@iga.in.gov

h83@iga.in.gov

h39@iga.in.gov

h60@iga.in.gov

h33@iga.in.gov

h35@iga.in.gov

h52@iga.in.gov

h96@iga.in.gov

h12@iga.in.gov

h26@iga.in.gov

h86@iga.in.gov

h2@iga.in.gov

h27@iga.in.gov

h43@iga.in.gov

h94@iga.in.gov

Why: Property taxes fund school district operation funds which pay for school buildings, buses, insurance, and maintenance. Record inflation has resulted in all of these categories costing more money for schools. As is, only 17 of 291 school districts are not transferring tuition support funds (which pays for teachers and classroom expenses) to operations to make up for the difference in existing property tax shortage.

It would be disastrous to reduce such a critical source of revenue used to educate our communities’ futures without a replacement plan. Serious changes, serious cuts would need to be made in most districts. Nothing is safe in many districts. Look for schools closing, larger classroom sizes, consolidating districts, putting building repairs and bus purchases on hold, reducing the number of elective and extracurriculars, higher out-of-pocket costs for parents for after school activities, and so on.

With cuts like this, it will be hard to convince young adults to stay in Indiana and attract new businesses offering good salaries to come to Indiana.

Public schools are the heart of our communities. It’s going to take a lot to stop the bleed from these reforms.

Food for thought: Legislators are searching for replacement revenue streams. How about the tax dollars sent to private schools via vouchers or many of the other places shown in our leaky bucket graphic? The state of Indiana is constitutionally obligated to fund public schools. These leaks are extras. If Indiana has to tighten its belt, the extras should be considered and the valves shut off.

Please share this with family and community members.