Leaky Bucket of Funding – Updated

As we prepare for the Indiana General Assembly to craft the state’s next two-year budget in January 2025, we again expect to hear legislators brag about more “historic funding increases” for K-12 education and, also, a lot more about “universal school choice.”

How can legislators keep saying they are funding Indiana schools while at the same time, your local public school district sees an increase that doesn’t even keep up with inflation? How is it that some schools actually see a decline? How is this possible?

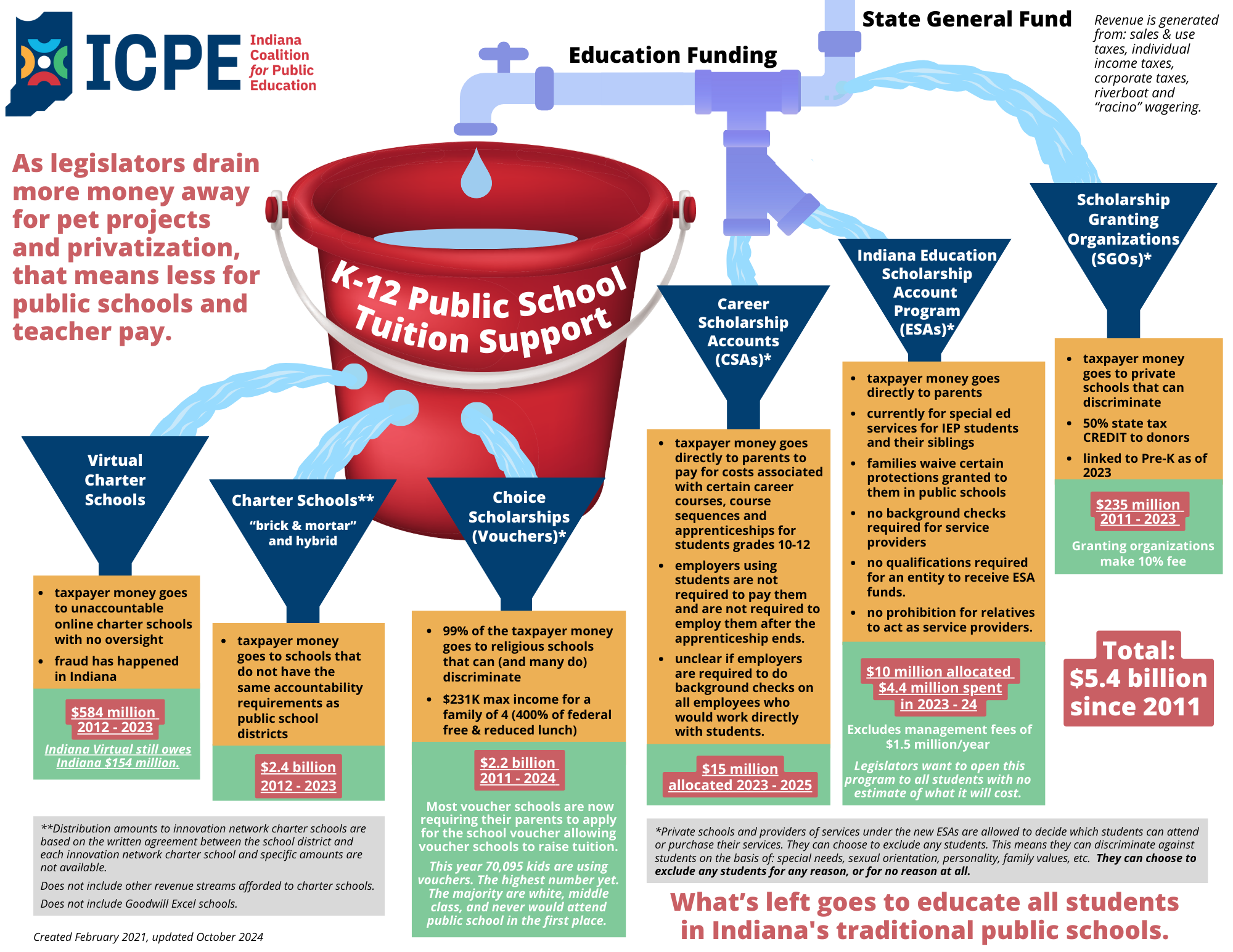

Indiana’s legislators have chosen to fund more than one education system from the bucket of funds that has historically been earmarked for public education. The first education system, the one required by Article 8, Section 1 of Indiana’s Constitution, is made up of Indiana’s traditional public schools that educate almost 90 percent of Indiana’s children. In recent years, the General Assembly has passed legislation to create public charter schools (the second system), and the state’s largest voucher program (the third system, called the Indiana Choice Scholarship Program) that provides tax subsidies to students to help pay for private education. We hesitate to call the charters and vouchers actual systems. At best, they are inefficient, unaccountable redundancies when compared to the public school system.

Charter schools and “innovation schools” are not the same as traditional public schools, though they are called that in state law. Charters and “innovation schools” do not share the following accountability requirements with public school districts: 1) to serve all students within a given geographic area, 2) to be governed by a democratically elected local board (“innovation schools” are outsourced within districts, while charters appoint their own boards), and 3) to follow the full body of state education law, including teacher certification requirements and financial reporting requirements.

Private schools that accept vouchers have no accountability requirements. There is no fiduciary oversight by the state of the voucher money. There are no requirements that keep voucher taxpayer dollars from being used to enable the receiving organization to redirect its existing money for non-education purposes. Private schools choose who they educate. And almost all of the voucher-accepting private schools are religious schools.

The most recent K-12 education budget (adjusted for inflation) is $500 million behind in funding compared to the 2009-2010 budget cycle. Meanwhile Indiana taxpayers are funding more students, more schools, and more redundancies. Your local public schools are having to do more with less from the state.

On top of that, as you can see from the bucket graphic, they are now pulling out more and more money before it even reaches the funding bucket by creating separate line items in the state budget for Education Savings Accounts (ESA) and Career Scholarship Accounts (CSA), two additional types of private education vouchers. Further upstream—before the funding reaches the funding flow—they offer huge tax credits for those who donate Scholarship Granting organizations that fund private schools. These are all leaks in the funding pipeline that our public schools depend on.

Our revised “leaky bucket” graphic shows how money is being diverted in multiple directions. Although the K-12 education budget is expected to increase for 2025–2026 budget cycle, public schools will get just part of it.

As ICPE’s founder, Dr. Vic Smith, has forewarned here, here, here, and here, in the 2025 legislative session, legislators will consider creating a vouchers-on-steroids program with the potential name of “Indiana Funding Students First Grant Program.” The program would consolidate the Choice Scholarship vouchers, ESAs, and CSAs under the oversight of the Indiana State Treasurer’s office, not the Indiana Department of Education.

If voucher program eligibility becomes universal, includes homeschool students, and has no caps, every single Indiana public school district stands to lose exponentially more. We Hoosiers can only pay so much in taxes. You can see the financial impact on your school district on this interactive graph, which shows the additional funds schools public schools would be receiving if money sent into the voucher program was spent on public education.

Losses to public school funding will grow in future years just as voucher expenses have grown since 2011. Vouchers, which cost $15 million the first year, now cost $439 million a year – reaching a cumulative total of $2.16 billion of taxpayers’ money as voucher eligibility continues to expand.1

As a result of these “leaks” in the bucket of public school funding, Indiana has dropped in per-pupil school funding from being number 15 in the U.S. in 2005 to number 38 in 2022. 2 Indiana’s average teacher salary went from ranking 27th in the nation in 2013 to 38th in 2023.3 And overall faith in public schools has dropped.

Hoosiers deserve better. Public education is expensive and should be expensive as all million-plus students in Indiana deserve a shot at meeting the academic standards defined by the state. Paying for more types of schooling is not only confusing, but a recipe for short-changing the education of Hoosier children. Taxpayers deserve more accountability too on how their tax dollars are spent—more fiscal guardrails and consumer protections. What we have now is reckless: year-over-year erosion of the formative experiences that we offer to all children through public schools.

Sources

- Indiana Choice Scholarship Program annual reports, https://www.in.gov/doe/students/indiana-choice-scholarship-program/

- U.S. Census, “Public Elementary–Secondary Education Finance Data,” state level tables, Table 11- States Ranked According to Per Pupil Elementary-Secondary Public School System Finance Amounts, 2001–2002 and 2022, www.census.gov/programs-surveys/school-finances/data/tables.html.

- NEA ranking and estimates reports, https://www.nea.org/research-publications.