Vic’s Statehouse Notes #373

Dear Friends,

The second half of the budget session has now begun. Budget proposals from the Governor and from the House are on the table. A public hearing on the Senate budget has been scheduled by a subcommittee of the Senate Appropriations Committee for Thursday, March 16, in Statehouse Room 431 after the Senate has adjourned their 10 a.m. floor session.

Key questions for public education advocates are clear:

- Will your tax money be given to families with high incomes of $220,000 (family of four) to pay for private or parochial school tuition that they are already able to pay for?

That’s what the House Republican budget calls for, along with removing all current pathways to vouchers that have restricted eligibility since the program started in 2011.

- Are the strong K-12 budget totals in the House Republican budget being used to conceal the huge increase in the privatization of Indiana schooling through the eye-popping voucher increase?

- Also, the House budget bill prohibits school districts from charging a fee to students for curricular materials, but there is no new line item for materials. Apparently, school districts are expected to pay for textbooks out of their general fund.

Let your legislators hear your support for a strong K-12 budget increase. Our public schools need a hefty increase during these times when inflation remains high.

Then let them know you deeply oppose expanding private school vouchers to high-income families when there is no supervision or accountability on how your tax dollars are spent!

Giving vouchers to high-income families

Bit by bit, taxpayer support for private and parochial tuition has been increased by the Republican leadership during the past twelve years. In 2011, when the watershed bill was passed to pay for private and religious school tuition with your tax money, only families with incomes under $42,000 were eligible. Families with incomes of $63,000 could get a 50% voucher.

Over the budget years, more and more tax money has been funneled to high-income families who are going to private schools already. The last budget debate in 2021 led to a jump to cover families up to a previously unheard of level of $154,000 for a family of four, no longer recognizable as a voucher program to help poor families go to private schools as originally justified.

Now the Republican budget leaders want to spend millions to raise the limit all the way up to $220,000 for a family of four.

Do these families really need your tax dollars? In the non-scientific viewer poll announced by Indiana Week in Review on PBS, 92% of viewers who responded to the poll said “No.”

Compare the new budget to the previous eight budgets

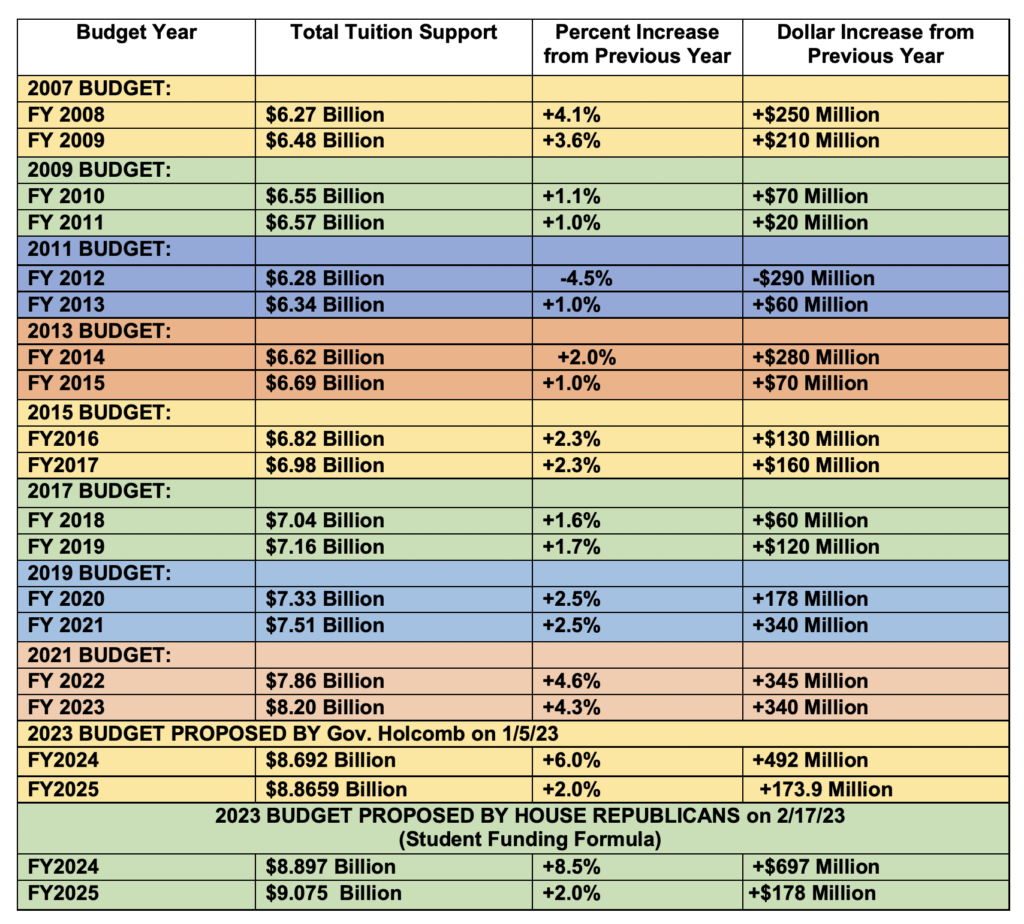

The chart below shows how two budget proposals stack up compared to the eight previous budgets:

1) the Governor’s budget plan announced January 5 and

2) the House Republican budget plan announced February 17.

The Senate is crafting its budget now and is holding their public hearing on the budget on Thursday in the Room 431 upon adjournment of the 10 a.m. session of the Senate. Perhaps you can go to the hearing and share your thoughts on the budget.

In 2021, the strong increase for K-12 tuition support was 4.6% in the first year and 4.3% in the second year. That was the best funding for K-12 since 1999 when the budget increased 4.7% in both the first and the second year of the budget. It should be remembered however that in that era, K-12 increases were funded with a combination of state money and local property tax. In 2021, the remarkable increases were all funded with state money.

Now we come to 2023 and both the Governor’s budget and the House budget raise the first year of the budget significantly. The Governor announced a 6.0% increase while the House announced an 8.5% increase. Both give only 2% in the second year of the budget.

A close inspection of the details shows that these two increases can’t be directly compared.

The House budget has a new line for operations which totals $115 million in the first year. This is funding to support local budgets for operations has not appeared in any previous budget. No line for operations is found in the Governor’s budget.

A fair comparison of the two budget proposals, then, would require subtracting the cost of operations ($115 million) from the House allotted figure of $8.897 billion in the first year. This comes to $8.782 billion, which is 7.1% above the current year budget of $8.20 billion, not 8.5% as announced.

Also please note that the House budget does not use the term “Tuition Support” for the biggest item in the budget, a term that has always been used in the previous budgets. The House budget changed the term to read “Student Funding Formula,” presumably because it covers operations and textbooks as well as general fund tuition.

Keep these confusing factors into account when comparing budget proposals:

INDIANA SCHOOL FUNDING INCREASES FOR THE PAST EIGHT BUDGETS FOR COMPARISON WITH GOV. HOLCOMB’S BUDGET {JANUARY) AND THE HOUSE BUDGET (FEBRUARY)

Source: The summary cover page from the General Assembly’s School Formulas for each budget and House Bill 1001 (the budget bill) in each year.

Prepared by Dr. Vic Smith, 3-12-23

When the school funding formulas are passed every two years by the General Assembly, legislators see the bottom line percentage increases on a summary page. Figures that have appeared on this summary are listed below for the last seven budgets I have personally observed as they were approved by the legislature.

Tuition support and dollar increases have been rounded to the nearest 10 million dollars.

A printable version of the chart is available at this link.

Total funding and percentage increases were taken directly from HB 1001 (the budget) and the School Funding Formula summary page. Sometimes in the first year of two budget years, the previous budget amount was not fully spent and the adjusted lowered base was used by the General Assembly to calculate the percentage increase. In this historical listing, the amount passed in the previous budget is used as the baseline to calculate increases and percentage changes.

Send messages to Senators this week supporting strong funding for K-12, but opposing the mammoth increase for private school vouchers. If you can go to the Senate budget hearing on Thursday morning to have your say, please do so.

Grassroots support of public education makes all the difference. Thank you for your active support of public schools in Indiana!

Vic’s Statehouse Notes and ICPE received one of three Excellence in Media Awards presented by Delta Kappa Gamma Society International, an organization of over 85,000 women educators in seventeen countries. The award was presented on July 30, 2014 during the Delta Kappa Gamma International Convention held in Indianapolis. Thank you Delta Kappa Gamma!

ICPE has worked since 2011 to promote public education in the Statehouse and oppose the privatization of schools. We need your membership to help support ICPE lobbying efforts. We need all ICPE members to renew their membership if you have not done so.

Our lobbyist, Joel Hand, represents ICPE extremely well. We need your memberships and your support to continue his work in 2023. We welcome additional members and additional donations. We need your help and the help of your colleagues who support public education! Please pass the word!

Visit ICPE’s website at www.indianacoalitionforpubliced.org for membership and renewal information and for full information on ICPE efforts on behalf of public education. Thanks!

Vic Smith is a lifelong Hoosier and began teaching in 1969, serving as a social studies teacher, curriculum developer, state research and evaluation consultant, state social studies consultant, district social studies supervisor, assistant principal, principal, educational association staff member, and adjunct university professor.

Vic received a Distinguished Alumni Award from the IU School of Education, he was named to the Teacher Education Hall of Fame by the Association for Teacher Education and received the 2018 Friend of Education Award from the Indiana State Teachers Association.